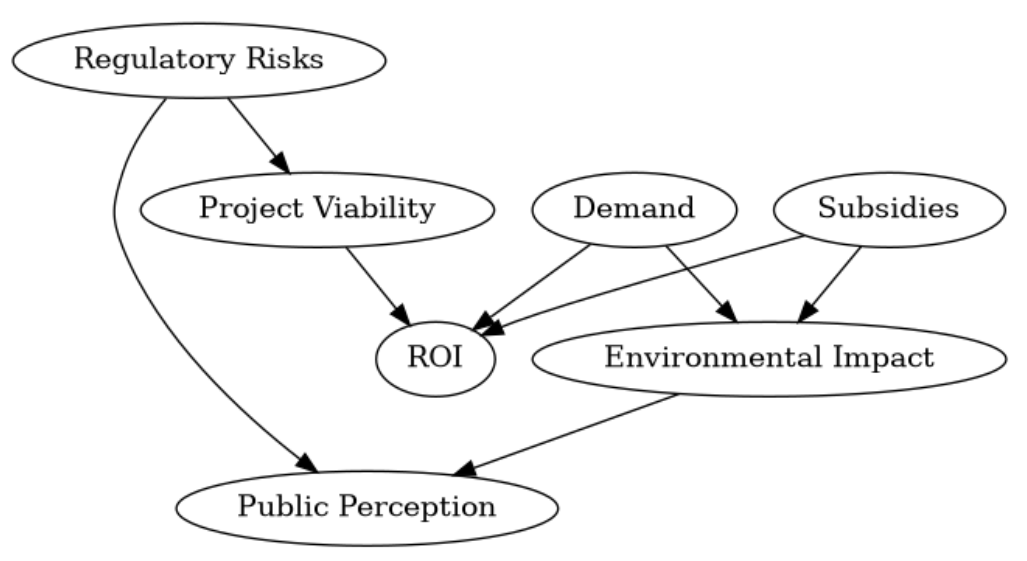

A decision-support tool for green investment using a custom Bayesian Network. It modelled how environmental risk, regulatory signals, and market indicators interact to shape the viability of sustainable ventures.

Project outline

This project implements a Bayesian Network for assessing sustainable investment decisions under uncertainty. Using pgmpy, it models probabilistic relationships between ESG, financial risk, and external policy changes.

The design draws on the latest edition of AI: A Modern Approach (Russell & Norvig), alongside recent academic research on Bayesian reasoning and probabilistic decision-making — grounding the model in both foundational theory and current applied methods.

Key features:

- Interactive Bayesian model built from domain knowledge and data

- Simulated scenarios to analyse sustainability outcomes

- Useful for policy planners and investors in green finance

- Awarded top marks (90%) by assessor

Media